Released February 12, 2026

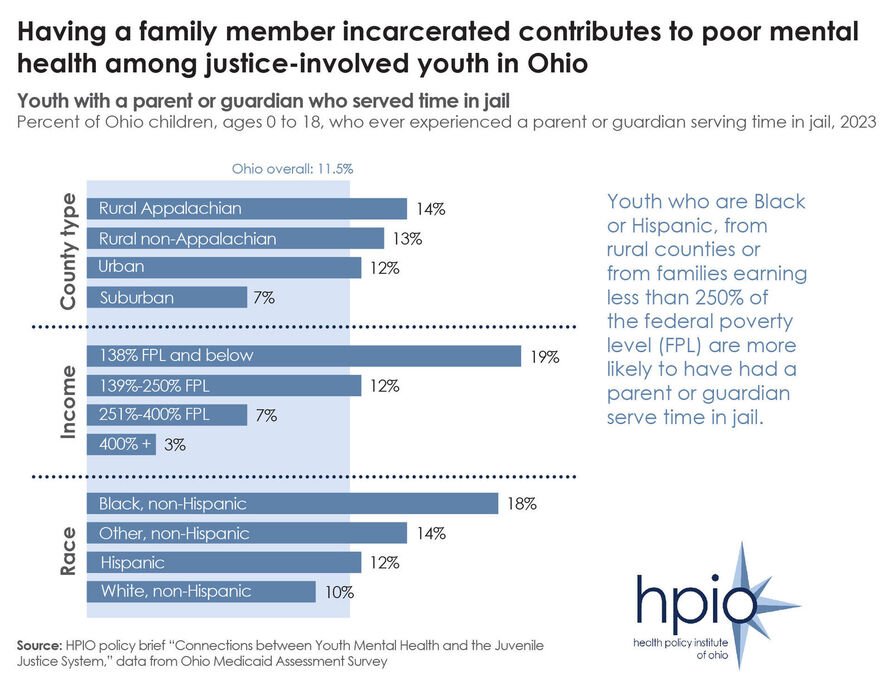

Data included in HPIO’s recently released policy brief on the Connections between Youth Mental Health and the Juvenile Justice System shows that Ohio youth who are Black or Hispanic, from rural counties and from families earning less than 250% of the federal poverty level (FPL) are more likely to have had a parent or guardian serve time in jail.

The brief found that there are several factors that contribute to poor mental health among children and teens, but some are more common among youth who become involved in the juvenile justice system, including adverse childhood experiences (ACEs).

Certain ACEs are more common among youth who become justice-involved, specifically sexual abuse, neglect and living in a household with someone who was incarcerated. According to HPIO’s Health Impacts of ACEs in Ohio brief, sexual abuse and incarceration of a household member are also two of the ACEs that have the most significant impact on the health of Ohioans.

The brief includes nine policy options that state policymakers can implement, and for which juvenile justice and child mental health partners can advocate, to improve mental health outcomes for at-risk youth and prevent justice involvement. The policy options, which were identified through a review of the U.S. Department of Justice Crime Solutions inventory, and through the expertise of the HPIO Child Mental Health advisory group, aim to prevent delinquent behavior, promote accountability, cultivate community safety and support the mental health of youth in detention or commitment.

Released February 06, 2026

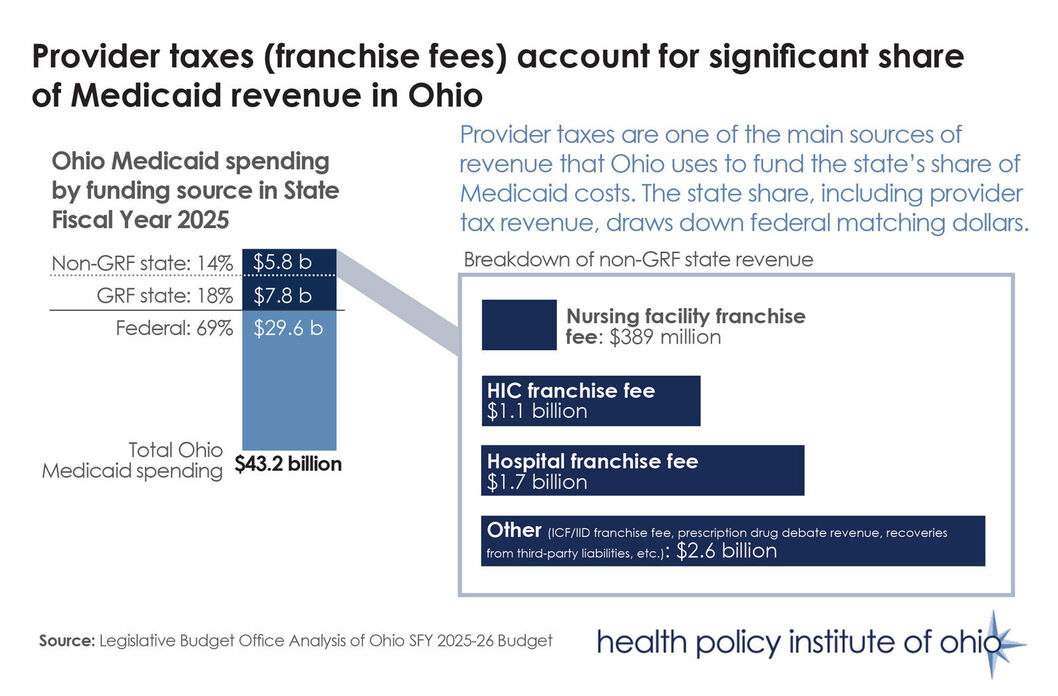

The federal government has begun releasing guidance on the implementation of new restrictions to provider taxes that many states, including Ohio, use to generate revenue to pay for their Medicaid programs (Sources: “CMS finalizes rule cracking down on Medicaid provider taxes,” Healthcare Dive, Jan. 30 and “CMS Issues New Guidance on H.R. 1’s Restrictions on State Use of Provider Taxes to Finance Medicaid,” Georgetown University Center for Children and Families blog, Nov. 18).

Medicaid is funded jointly by states and the federal government. Provider taxes comprise approximately 17% of state Medicaid funds nationally. Ohio’s three largest provider taxes accounted for $3.2 billion in state revenue in SFY2025, as illustrated above. Provider taxes draw down federal matching dollars, enabling states to increase and improve healthcare access for residents.

Changes to provider tax rules included in HR 1, sometimes referred to as the One Big Beautiful Bill Act, will reduce federal Medicaid spending by $226 billion over the next decade, according to the Congressional Budget Office. For example, unless Ohio leaders change pieces of the state’s existing Health Insuring Corporation (HIC) franchise fee to comply with the new federal rules, Ohio could lose approximately $3 billion a year in decreased taxes collected and federal draw-down amounts starting in SFY 2028. Other provisions in HR 1 will affect Ohio’s hospital franchise fee in the coming years as well.

HPIO plans to release a policy explainer on Medicaid financing in the coming weeks that will provide additional details on how Ohio pays for its Medicaid program and highlight upcoming decisions state policymakers will face in response to federal policy changes.

Released January 30, 2026

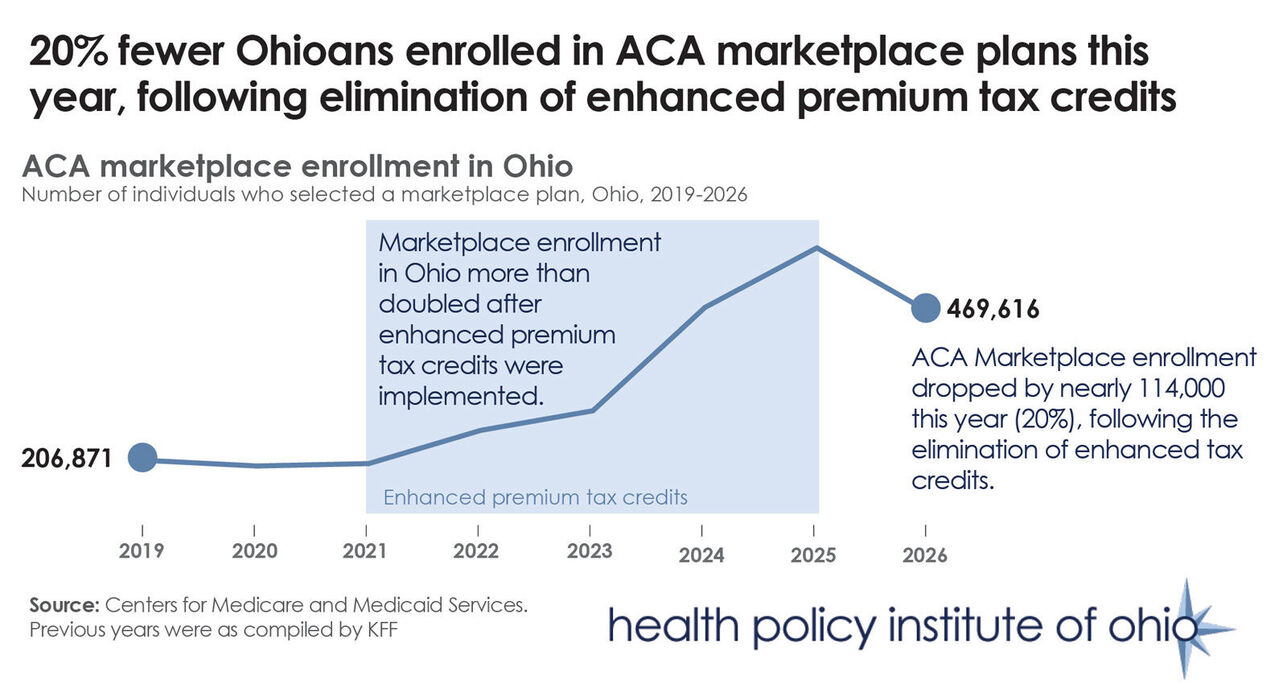

Data released this week by the Centers for Medicare and Medicaid Services shows that 469,616 Ohioans enrolled in Affordable Care Act (ACA) marketplace coverage in the open enrollment period that ended Jan. 15, a decrease of nearly 114,000 from last year (20%), as illustrated above.

Ohio saw the second-largest percentage drop in enrollment of any state in the country following the expiration of enhanced premium tax credits.

The national drop in enrollment was 5%, with states running their own exchanges retaining more enrollment than those, like Ohio, that use the federally operated exchange. According to KFF analysis, the drop in enrollment is likely to be even steeper in coming months because “people who have selected a plan or been automatically renewed may not ultimately choose to pay for their plan, thus ‘effectuating’ their coverage.”

Marketplace enrollment in Ohio had more than doubled between 2021 and 2025, when COVID-era enhanced subsidies decreased monthly premiums by 41%. The tax credits were at the center of the federal government shutdown last year, with Congress ultimately failing to reach an agreement on extending them.

While data on average premium payments in 2026 have not been released, the expiration of the tax credits was expected to increase premiums, on average, by 114% in 2026.

In November, HPIO released a policy explainer that provides background about the ACA marketplaces and details how recent changes to the marketplace could impact Ohioans in 2026.

Released January 22, 2026

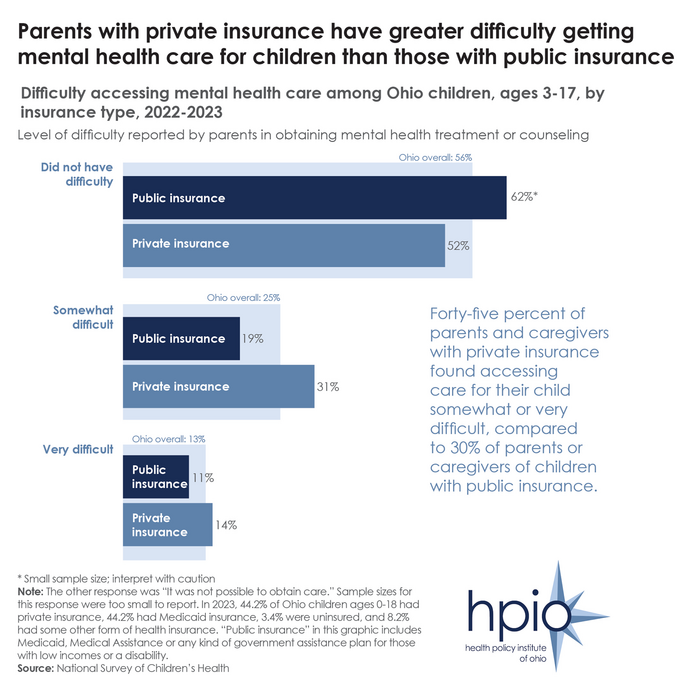

Data used in HPIO’s recent policy brief on child mental health in Ohio shows that in 2022-2023, among Ohio children needing mental health treatment, 38% found it somewhat or very difficult to access treatment (as displayed above). Data also shows more difficulty among individuals with private (i.e., commercial) insurance.

”Children with commercial insurance and young children were two groups commonly mentioned by subject matter experts as frequently experiencing challenges accessing mental health care,” the brief stated.

This brief focuses on access to mental healthcare services across levels of care. As part of the release, HPIO also released a community voice spotlight on parent and caregiver experiences with barriers to child and youth mental health care.

It is the third of four planned policy briefs in HPIO’s Ohio Child Mental Health Project.

Released January 16, 2026

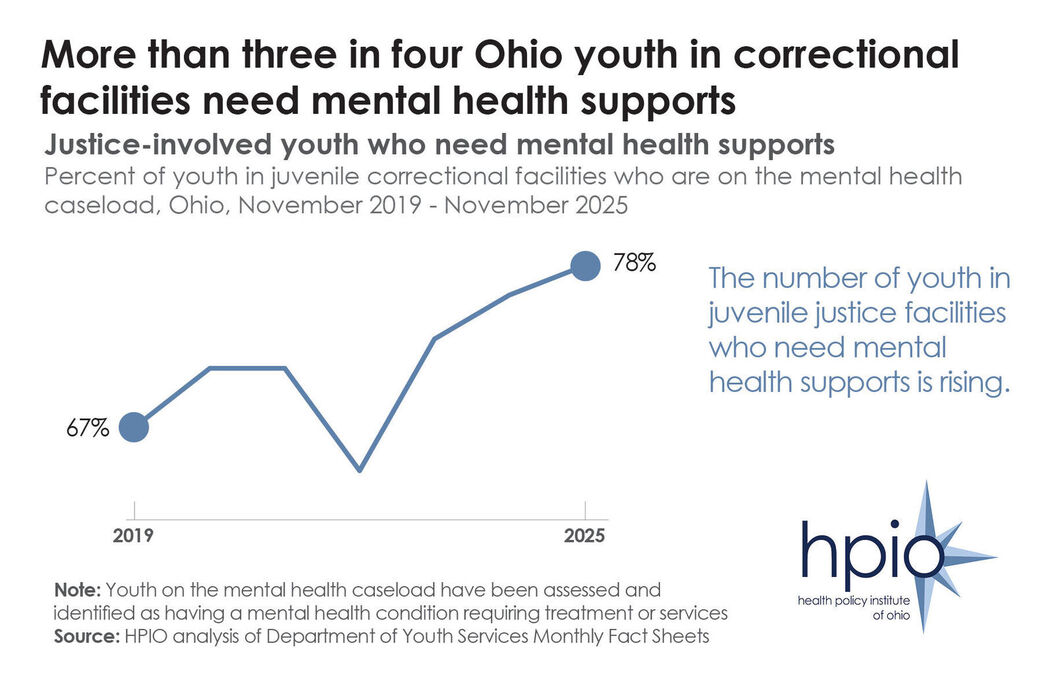

The Health Policy Institute of Ohio has released a new policy brief on the connections between youth mental health and the juvenile justice system.

The brief outlines the root causes of mental health challenges for youth at risk for justice involvement and gives an overview of the juvenile justice system, including at what points in the process youth mental health can be supported.

Data included in the brief shows that youth in juvenile justice facilities have higher rates of mental health disorders, including depression, obsessive-compulsive disorder, suicidal ideation and suicidal behavior.And the percent of Ohio youth in juvenile correctional facilities who need mental health supports has increased in recent years, as illustrated above.

The brief also includes nine policy options that state policymakers can implement, and for which juvenile justice and child mental health partners can advocate, to improve mental health outcomes for at-risk youth and prevent justice involvement. The policy options, which were identified through a review of the U.S. Department of Justice Crime Solutions inventory, and through the expertise of the HPIO Child Mental Health advisory group, aim to prevent delinquent behavior, promote accountability, cultivate community safety and support the mental health of youth in detention or commitment.

“Many experiences shape the mental health of children and youth, including relationships with family and peers, traumatic events and interactions with the juvenile justice system,” the brief states. “By ensuring the health and well-being of children, juvenile justice policies can prevent delinquent behavior and improve community safety.”