Released January 16, 2026

The Health Policy Institute of Ohio has released a new policy brief on the connections between youth mental health and the juvenile justice system.

The brief outlines the root causes of mental health challenges for youth at risk for justice involvement and gives an overview of the juvenile justice system, including at what points in the process youth mental health can be supported.

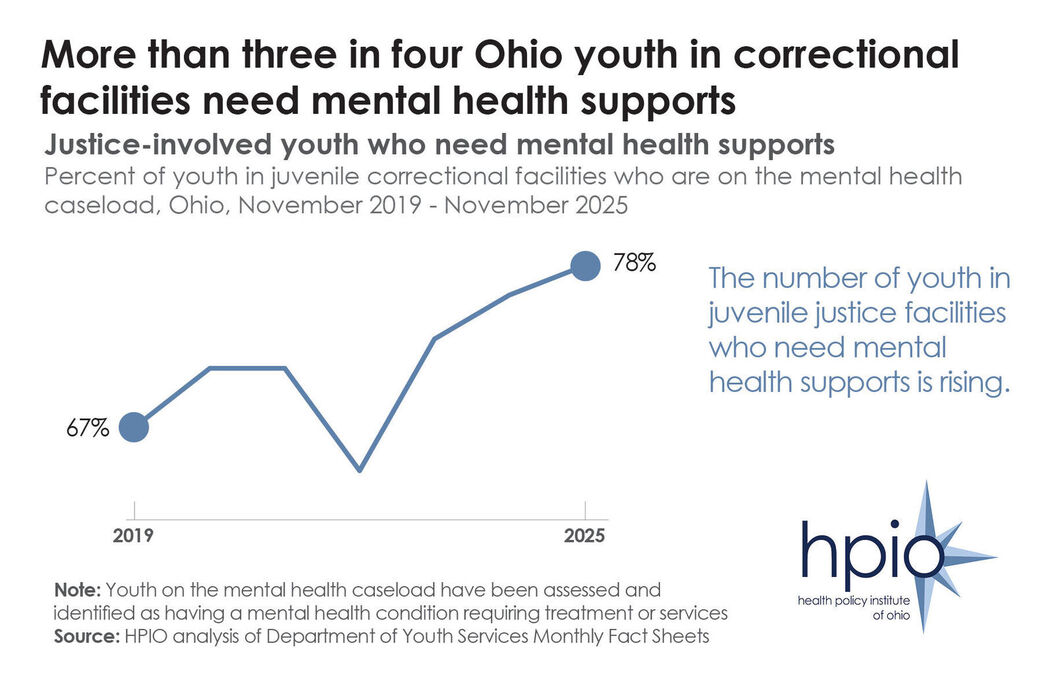

Data included in the brief shows that youth in juvenile justice facilities have higher rates of mental health disorders, including depression, obsessive-compulsive disorder, suicidal ideation and suicidal behavior.And the percent of Ohio youth in juvenile correctional facilities who need mental health supports has increased in recent years, as illustrated above.

The brief also includes nine policy options that state policymakers can implement, and for which juvenile justice and child mental health partners can advocate, to improve mental health outcomes for at-risk youth and prevent justice involvement. The policy options, which were identified through a review of the U.S. Department of Justice Crime Solutions inventory, and through the expertise of the HPIO Child Mental Health advisory group, aim to prevent delinquent behavior, promote accountability, cultivate community safety and support the mental health of youth in detention or commitment.

“Many experiences shape the mental health of children and youth, including relationships with family and peers, traumatic events and interactions with the juvenile justice system,” the brief states. “By ensuring the health and well-being of children, juvenile justice policies can prevent delinquent behavior and improve community safety.”

Released January 09, 2026

The Health Policy Institute of Ohio has released a new policy explainer on Rural Health Transformation Program funding in Ohio.

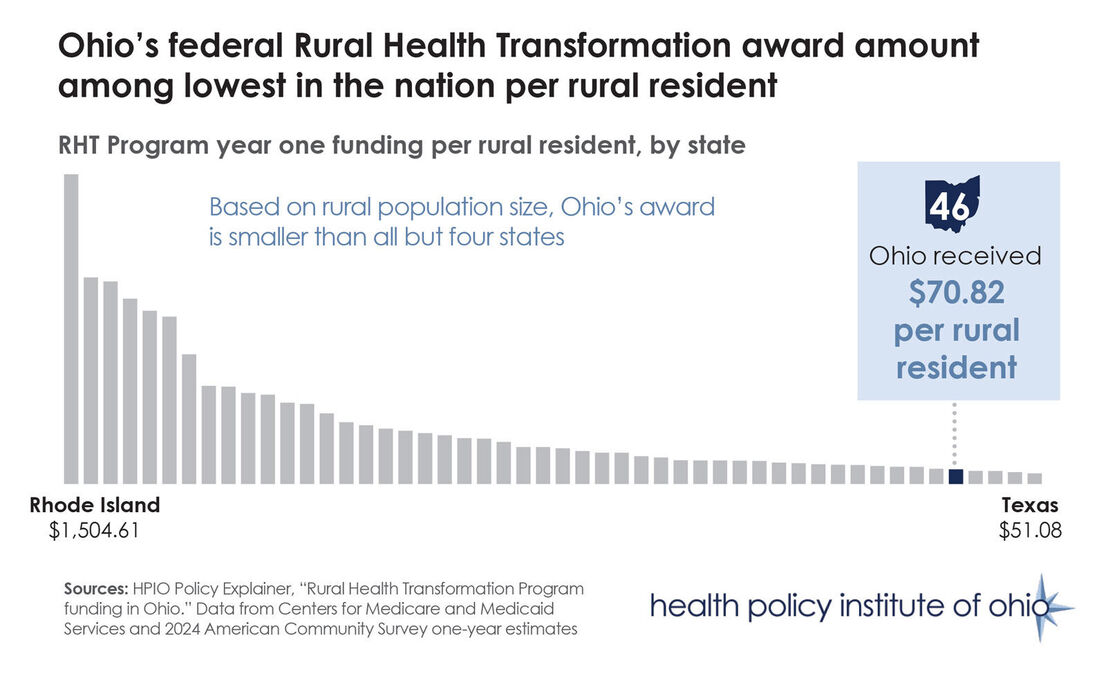

On Dec. 29, 2025, the Centers for Medicare and Medicaid Services announced first-year Rural Health Transformation (RHT) Program awards. Ohio will receive a total of $202,030,262, the 25th highest total amount. However, according to HPIO’s analysis, Ohio was awarded the 46th-most funding per rural resident, as illustrated above.

The RHT program was created as part of the federal reconciliation bill HR 1, sometimes referred to as the One Big Beautiful Bill Act, which was signed into law in July 2025. RHT will allocate $50 billion to states over five years, with $10 billion allocated in the first year.

Half of the first-year funding was awarded evenly among all 50 states ($100 million per state) and the other half was awarded based on state-submitted applications. The federal government scored state plans based on factors including rural population and the proportion of rural health facilities in the state, as well as states’ adoption of certain policy priorities, such as restricting the purchase of unhealthy foods and drinks with SNAP benefits, scope of practice expansion and loosening certificate of need laws.

Even after subtracting the portion of funding allocated equally to states (which inherently disadvantages larger states like Ohio), the state received the fifth-lowest amount of funding per rural resident from the application-based portion of the award.

While Ohio will receive more than $202 million in federal dollars this year through the RHT Program, the funding will not replace all of the losses to rural health funding expected due to other provisions in HR 1 ($5.6 billion for Ohio over the next 10 years, according to KFF estimates).

Released December 09, 2025

The Health Policy Institute of Ohio has released a new brief titled “Access to Mental Health Care for Ohio Children and Youth.”

The brief is the third in HPIO’s Ohio Child Mental Health Project.

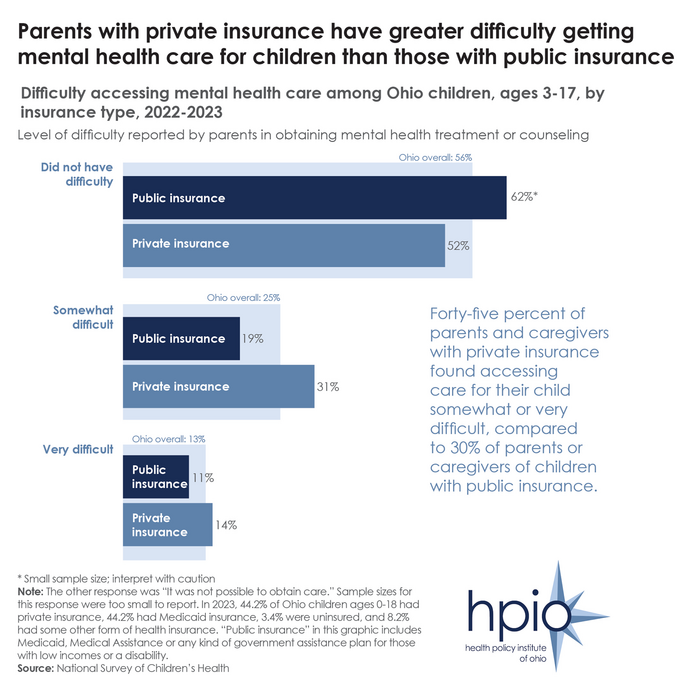

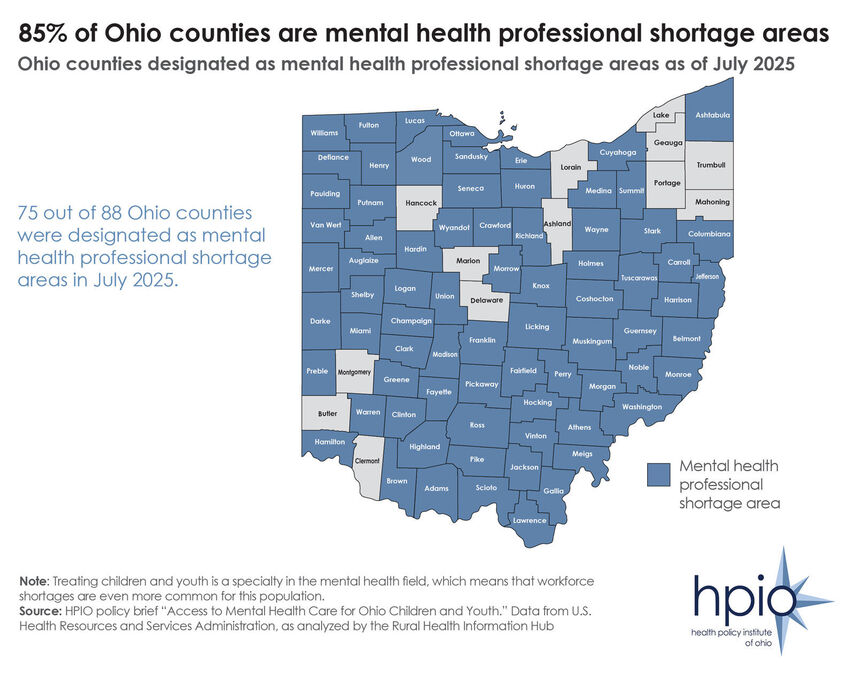

Many Ohio children and youth are struggling with mental health conditions. Early identification and treatment can keep them on a path toward well-being and realizing their full potential. However, families around the state are encountering various barriers to getting children the treatment they need, including critical provider shortages (as illustrated above), high costs of care and difficulties navigating the health and insurance systems.

Further, significant gaps in data availability are limiting policymakers’ ability to make data-driven decisions regarding how to improve access to mental health care, which could improve the well-being of young Ohioans and decrease costs for years to come.

This brief focuses on access to mental healthcare services across levels of care. As part of the release, HPIO is also releasing a community voice spotlight on parent and caregiver experiences with barriers to child and youth mental health care.

Released November 21, 2025

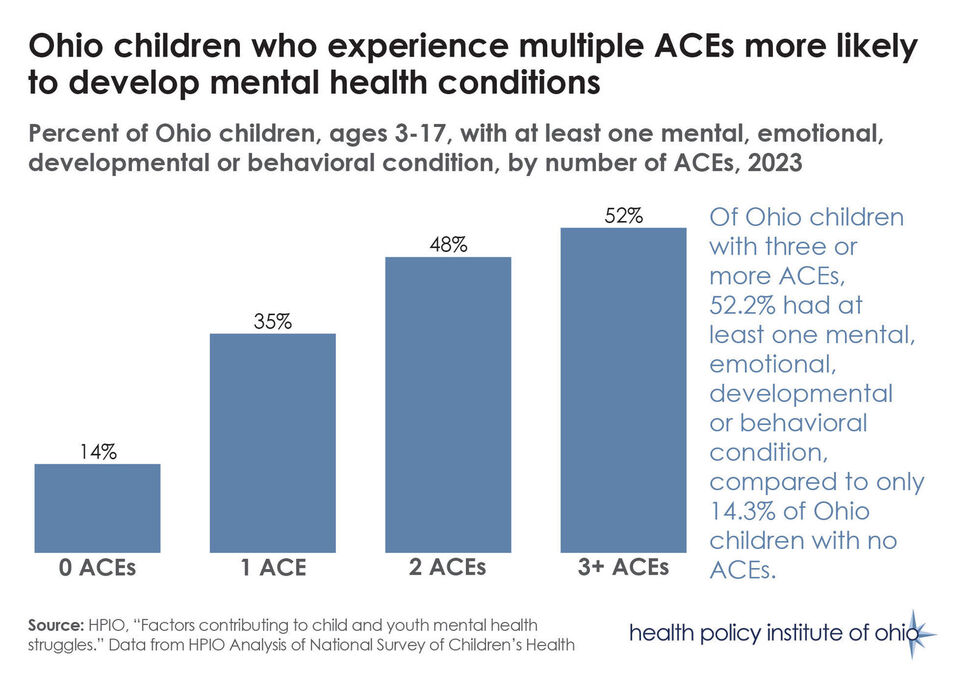

Data on Ohio children shows that those who experience adverse childhood experiences (ACEs) are more likely to have at least one mental, emotional, developmental or beahavioral condition, as illustrated above.

ACEs are potentially traumatic events that occur during childhood. These can include abuse, neglect or other household challenges, such as living with someone with a mental health condition or substance use disorder or who experienced incarceration. There is clear evidence that ACEs negatively affect brain development and increase the likelihood of numerous physical and mental health conditions through adulthood.

The data was included in HPIO’s policy brief “Factors Contributing to Child and Youth Mental Health Struggles.” The brief, which was released in July, is the second in a series of four planned HPIO publications on child and youth mental health.

The brief describes how each factor influences child and youth mental health, the extent to which it exists in Ohio and what the state is doing to address it. Finally, it presents a variety of policy options that could be implemented to address each topic.

Next Month HPIO is planning to release the third brief in the Child Mental Health series. The new publication will focus on access to mental healthcare services for Ohio children across levels for care.

Released November 07, 2025

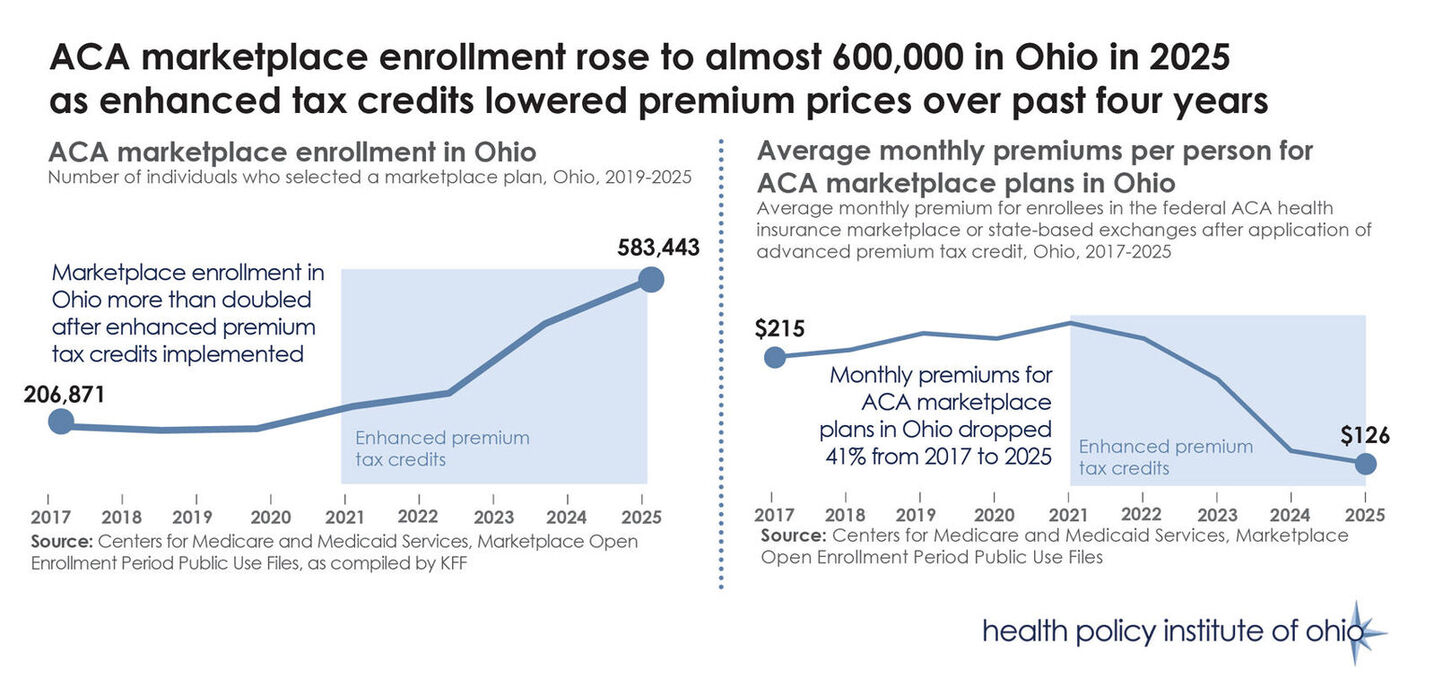

The Health Policy Institute of Ohio has released a new policy explainer on changes to the federal health insurance marketplace.

The Affordable Care Act health insurance marketplaces are at the center of the federal government shutdown, particularly the upcoming expiration of enhanced premium tax credits that reduce the cost of these insurance plans for consumers. The debate over extending the enhanced credits comes at the same time as broader conversations on the difficulties that Ohio families are facing with the cost of living and increased cost of health insurance.

Nearly 600,000 Ohioans got health insurance through the marketplace in 2025. With enhanced tax credits expiring next year and large increases in the cost of premiums, more than 100,000 Ohioans are expected to no longer purchase insurance coverage in 2026.

The policy explainer is the latest in a series of publications that HPIO has developed to explore the healthcare access and affordability impacts of recent policy changes, such as HR 1 and the state’s biennial budget bill.