- Posted

- February 06, 2026

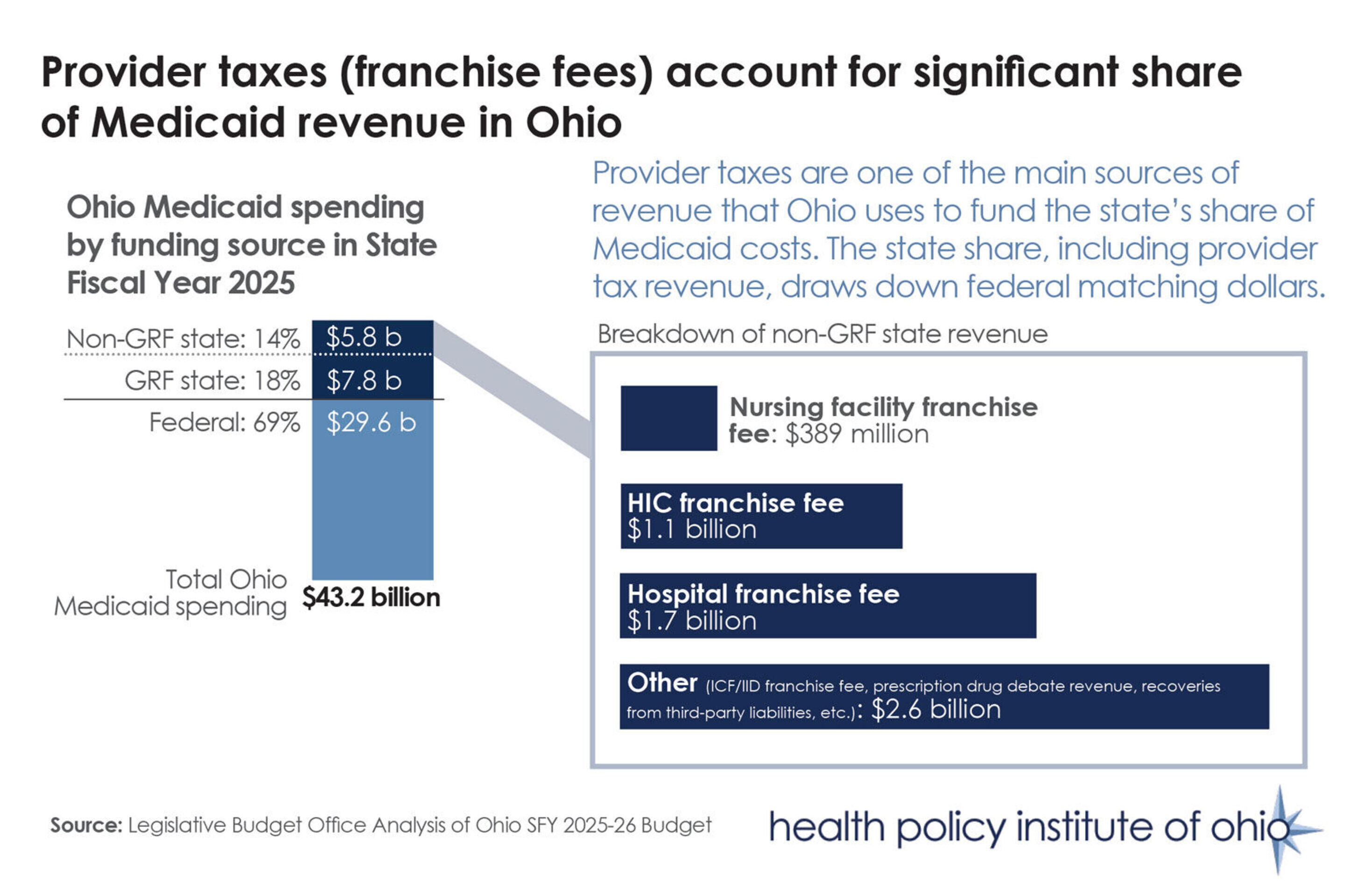

Graphic of the week: Provider taxes and Ohio Medicaid revenue

click to enlarge

The federal government has begun releasing guidance on the implementation of new restrictions to provider taxes that many states, including Ohio, use to generate revenue to pay for their Medicaid programs (Sources: “CMS finalizes rule cracking down on Medicaid provider taxes,” Healthcare Dive, Jan. 30 and “CMS Issues New Guidance on H.R. 1’s Restrictions on State Use of Provider Taxes to Finance Medicaid,” Georgetown University Center for Children and Families blog, Nov. 18).

Medicaid is funded jointly by states and the federal government. Provider taxes comprise approximately 17% of state Medicaid funds nationally. Ohio’s three largest provider taxes accounted for $3.2 billion in state revenue in SFY2025, as illustrated above. Provider taxes draw down federal matching dollars, enabling states to increase and improve healthcare access for residents.

Changes to provider tax rules included in HR 1, sometimes referred to as the One Big Beautiful Bill Act, will reduce federal Medicaid spending by $226 billion over the next decade, according to the Congressional Budget Office. For example, unless Ohio leaders change pieces of the state’s existing Health Insuring Corporation (HIC) franchise fee to comply with the new federal rules, Ohio could lose approximately $3 billion a year in decreased taxes collected and federal draw-down amounts starting in SFY 2028. Other provisions in HR 1 will affect Ohio’s hospital franchise fee in the coming years as well.

HPIO plans to release a policy explainer on Medicaid financing in the coming weeks that will provide additional details on how Ohio pays for its Medicaid program and highlight upcoming decisions state policymakers will face in response to federal policy changes.