Ohio Health Value Review

November 2023

The Ohio Health Value Review is a quarterly electronic update from the Health Policy Institute of Ohio designed to highlight opportunities for policymakers and stakeholders to improve health value in Ohio. If you have questions about the newsletter or have suggested tools or resources you would like to see included in future editions, please contact Nick Wiselogel, HPIO’s Vice President of Strategic Communications.

Health value graphic

In May, HPIO released the fifth edition of its biennial Health Value Dashboard. The 2023 Dashboard found that Ohio ranks 44th in the nation in health value, a combination of population health and healthcare spending. This means that Ohioans are less healthy and spend more on health care than people in most other states.

The Dashboard identified specific areas of strength on which Ohio can build to create opportunities for improved health value in the state. One of those areas is strengthening Ohio’s workforce and reducing poverty by building upon recent success in attracting employers in high-growth industries.

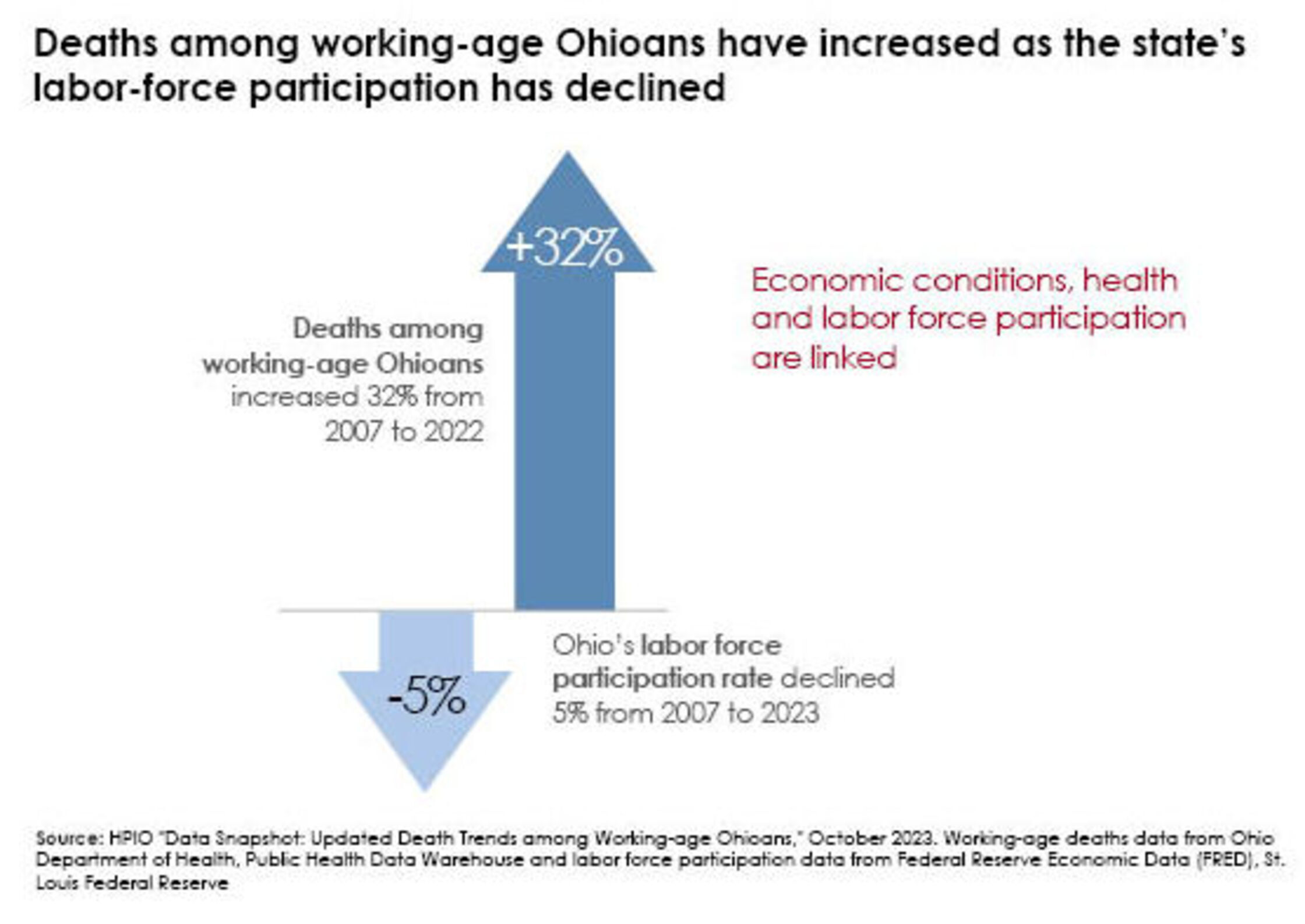

Ohio’s workforce is facing serious challenges. As illustrated below, deaths among working-age Ohioans have increased over the last 15 years as labor force participation continues its long-term decline, with Ohio falling behind most other states (For more information, see HPIO’s updated data snapshot “Death Trends among Working-age Ohioans”).

However, the state’s strong manufacturing base, strategic location and educational infrastructure has attracted major employers, such as Intel, Honda, Ford and LG Energy Solutions, to invest in the state in the past few years. Ohio is home to 200 corporate headquarters, 14 public universities and 23 community colleges. Further building upon these strengths can lead to a robust workforce that meets the needs of employers, re-invigorates local communities and increase earnings, which will, in turn, reduce poverty and improve health.

Health value resources

The resources below, organized by the domains in HPIO’s Health Value Dashboard, can be used to help improve health value in Ohio.

Population health and healthcare spending

- State Protections Against Medical Debt: A Look at Policies Across the U.S. – Commonwealth Fund

- A Population Health Workforce to Meet 21st Century Challenges and Opportunities – The National Academies of Sciences, Engineering, and Medicine

Social and economic environment

- Data Snapshot: Adverse Childhood Experiences in Ohio – HPIO

- Data Snapshot: Updated Death Trends among Working-age Ohioans – HPIO

- The Impact of Supplemental Nutrition Assistance Program (SNAP) Enrollment on Health and Cost Outcomes – NEJM Catalyst

Physical environment

- Navigating Climate-Related Threats to the Public’s Health – Trust for America’s Health

- Forging Climate Solutions: How to Accelerate Action Across America – Public Health Institute

- Mental Health and Our Changing Climate: Children and Youth Report 2023 – ecoAmerica and the American Psychological Association

- How Health Care Contributes to Climate Change — and How We Can Reverse the Trend – Commonwealth Fund

Access to care

- Ensuring Continuous Eligibility for Medicaid and CHIP: Coverage and Cost Impacts for Children – Commonwealth Fund

- Medicaid Managed Care for Children and Youth with Special Health Care Needs: 50-State Scan – National Academy for State Health Policy

- Improving Access to School-Based Behavioral Health Services Through Medicaid – Commonwealth Fund

Healthcare system

- A Formal Framework For Incorporating Equity Into Health Care Quality Measurement – RAND Corporation

- Long-Term Services and Supports State Scorecard 2023 Edition – AARP Foundation

Public health and prevention

- The Uneven Recovery from the COVID-19 Pandemic: Recent Insights from the Opportunity Insights Economic Tracker – Opportunity Insights

- 2022 Behavioral Risk Factor Surveillance System dataset – Centers for Disease Control and Prevention

- Associations between state-level general population alcohol policies and drinking outcomes among women of reproductive age: Results from 1984 to 2020 National Alcohol Surveys – Alcohol Clinical and Experimental Research

Health equity

- Social Drivers of Infant Mortality: Eliminating Racism Action Guide – HPIO

- Advance Equitable Evaluation by Centering the Lived Experiences of People with Disabilities in Research – Mathematica

- Survey: Public Health Employees Eager to Address Racism as A Public Health Crisis – de Beaumont Foundation

- State Health Equity Initiatives Confront Decades of Racism in the Insurance Industry – Commonwealth Fund